All startup companies require capital of some kind. In the initial stages of a company, funding can be hard to find. Most founders get started by using personal funds, bootstrapping money from personal savings, loans and credit cards, or using revenue from the company’s profit to reinvest back into the company (known as sales-led growth strategy). When businesses need to scale at a faster pace than these methods provide, they will often turn to outside investors to fuel the growth of their company.

It is important to note that less than 1% of all companies raise angel or venture capital. The companies that do are typically launching a hot new technology and they need a large amount of capital to launch and scale quickly, or they are developing a new pharmaceutical and need long-term capital to undergo many years of tests and trials. In other words, if you’re launching a traditional brick-and-mortar business, it’s highly unlikely you need investment capital.

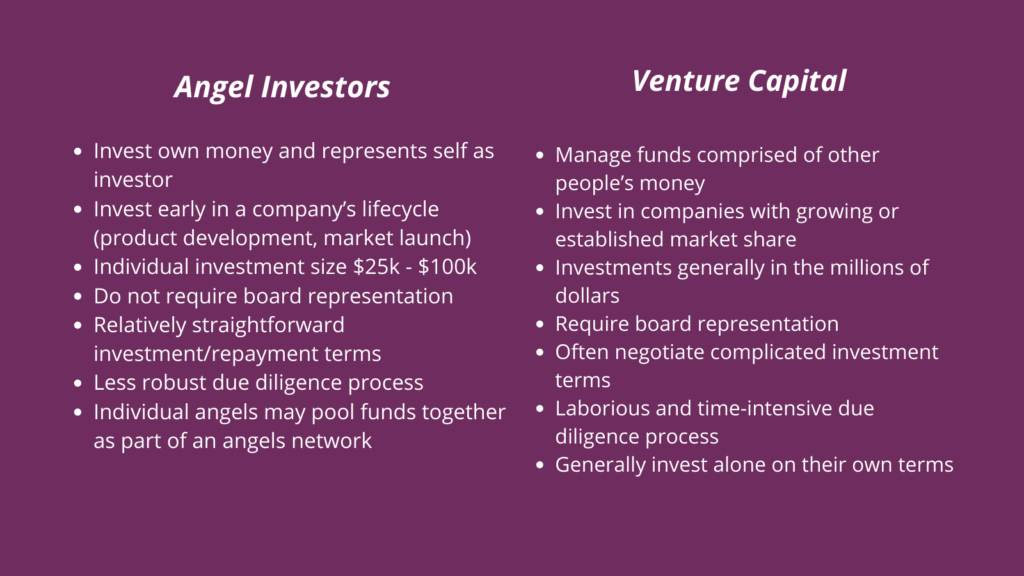

For those companies that do require outside investment, Angel Investors and Venture Capitalist are the two most common ways that companies secure outside funding. Both investors have a similar process for determining whether or not to invest:

- Screening happens during the initial pitch where entrepreneurs detail the company and the investment opportunity. Less than 15% of companies progress past this stage.

- Socialization is an extension of the screening process where the company in introduced to additional members of the VC firm. Again less than 15% of remaining companies progress past this step.

- Due diligence is where the investors thoroughly research the investment opportunity including evaluating the team, financials, etc. Roughly 10% of remaining firms move past this step.

- The final step is the decision from the investors. If the answer is yes, entrepreneurs will receive a term sheet with the terms and conditions that the entrepreneurs must accept to receive the capital. As we mentioned, less than 1% of firms receive outside investment.

Now that you’re familiar with the general process, read on to learn about the differences between angel and VC investment.

Angel Investors & Angel Networks

Entrepreneurs typically start with angel investors when they need more money than they can raise from their own savings or loans and credit cards. Angel investors are high net worth individuals who invest their own funds into early-stage startups. Angels invest anywhere from tends of thousands to millions of dollars. Angels will undergo a due diligence process to determine financials and other key information relevant for making an investment decision.

Often angel investors will come together to form Angel Networks, which allow them to combine their collective funds, experience, or influence to make better investments. They invest in companies as individuals or as a group and receive ownership of some portion of the company.

Venture Capital

Venture Capital (aka VC) is typically accessible once a company has demonstrated a solid market and sales and needs a large capital infusion to scale rapidly. VC firms make larger investments than angels and raise and manage funds representing numerous large-scale investors. The VCs typically receive some equity ownership of the company plus royalties or other payouts based on revenue generated. VC firms often ask for a seat on the company’s board. The VC due diligence process is much more in-depth and the expectation for financial returns will be higher than for angels.

The graphic below illustrates the primary differences between angel and venture capital investors.

This post is part of our larger series on the Five Types of Funding Capital. Click here to find out information on the other types of capital available to launch or grow your company.

Check out these local Angel Investors and Venture Capital firms:

- Fine Line Ventures is an early-stage venture fund that backs founders and ventures with a meaningful connection to Forth Worth. Contact: [email protected]

- Cowtown Angels: Fort Worth based Angel network that connects entrepreneurs seeking early-stage funding with local investors in an environment that accelerates growth and rewards strategic risk-taking.

- North Texas Angel Network: A Dallas based Angel Network aimed at supporting North Texas entrepreneurs

- Dallas Angel Network: The Dallas Angel Network links angel investors in Dallas with startups and high growth companies in Dallas, Houston, and Austin.

- Tech Wildcatters: The #1 B2B startup program in the nation and #5 overall (according to INC). We invest in elite early-stage startups + their founders and turn them into companies.

- REVTECH Ventures: accelerates the growth of top-tier, retail tech startups through seed funding, mentorship, and strategic connections.

- Venture Dallas: Venture Dallas is a 501-c-6 nonprofit, volunteer led organization dedicated to growing the innovation ecosystem in Dallas-Fort Worth.

This post is a collaborative effort by Marco Johnson, Sparkyard Network Builder, and Kendel Rogers, Outreach Specialist at the UNT Health Science Center.

About the Author

Marco Johnson is the Sparkyard Network Builder, a position funded by the UNTHSC. He is a Fort Worth resident and Global Citizen whose professional journey has led him to exotic, faraway locations including Eastern Europe, Central Asia, sub-Saharan Africa, and the planet Neptune to name a few. He is skilled in entrepreneurial ecosystem building, impact investing, international agricultural development, private equity finance, and fine-tuning Weber carburetors. He is a Virgo and his spirit animal is a Tesla coil. All thoughts, views, and comments are his own and do not reflect the thoughts, views, or comments of The University of North Texas Health Science Center.