Early Stage Capital Slips Again

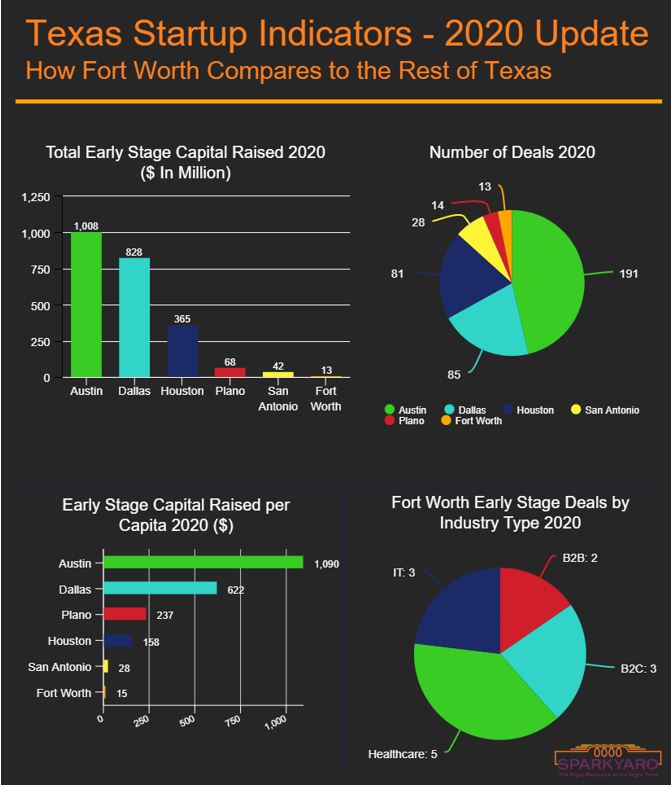

Fort Worth-based startup companies raised $13 million in early stage capital in 2020. If that sounds low, it’s because it is, especially when compared to other large Texas cities and to the nation as a whole. In fact, while the United States set a 10 year high for most capital invested ($148B), Fort Worth actually slipped in its funding efforts, raising $4 million less than our previous five-year average of $17 million per year.

In the past, we’ve looked at early-stage capital raised in Texas’s largest cities. This time we are taking a look at 2020’s updated numbers to see how COVID-19 has impacted local funding. In previous comparisons, we analyzed data from Austin, Houston, Dallas, and San Antonio. We are expanding our scope to include Plano in order to provide a better comparison of data in the DFW area. All data is provided by PitchBook.

Figure 1 shows early-stage investment in Texas cities in 2020. In the past year, Fort Worth’s $13 million raised means we still lag far behind our neighbors. For a city whose population is the 13th largest in the nation, this investment number simply isn’t enough to fund local investable startups and will send a signal to local entrepreneurs that local funding is scarce. Fort Worth will essentially be pushing local entrepreneurs to pursue funding opportunities elsewhere – like Dallas and Plano. In many cases, companies relocate to be closer to investors, meaning Fort Worth would lose the myriad of benefits that startups generate. Fort Worth already has a negative reputation from entrepreneurs when it comes to the availability of local funding, and this could be enough to dissuade some entrepreneurs from ever even launching their venture.

Perhaps the most interesting finding of this analysis is how well Plano has been doing comparatively. Because of its proximity to Dallas, Plano could be experiencing some kind of entrepreneurial trickle-down effect. With continued efforts and entrepreneur-friendly policies and plans in Fort Worth, who’s to say our city can’t steal a page from Plano’s book?

Major highlights from the data analysis:

- COVID-19 doesn’t seem to have had a major impact on early stage deals in major Texas cities, with Austin reporting a more than $400 million increase from its five-year average while Dallas reported an even more eye-opening $600 million increase from its five-year average.

- Fort Worth lags behind our neighboring cities in most of the early-stage investment metrics we have considered here.

- The DFW area is dominated by Dallas, but proximity to Dallas has more than likely helped Plano, who has raised $68 million in early stage capital in 2020.

- Perhaps the best route to pursue at this point is to focus on Fort Worth’s already existing assets and talent, such as its vast healthcare and aerospace infrastructures, in order to create synergies within and between key industries and centers of expertise (universities, etc.).

- More research needs to be conducted to determine if there is some kind of a talent leak of promising entrepreneurs from Fort Worth to other Texas cities due to a lack of proper early-stage investment options.

In conclusion, why should Fort Worth focus on startups? The answer is simple: startups are a leading source of job creation. In 2018 alone, startups created more than 25,000 jobs in Fort Worth (Read here). This is just one small indicator of how transformative a good startup environment can be for a city like Fort Worth. In the last 10 years, the population grew by more than 150,000 people, and we are certain that this includes people who have game-changing ideas but might be lacking resources. The growth of our local economy depends on it.

Interested in seeing more stats on the Fort Worth entrepreneurial ecosystem? Click here to view other data related posts.

This post is a collaborative effort by Sreejith Kizhakkeveettil and Trent Barron, HSC Next Innovation Ecosystem interns,