In other posts on this blog, we have looked at early-stage funding trends for Fort Worth-based companies over a five year period. But, what if we could go back over a longer term and see what has been happening over a 20 year period?

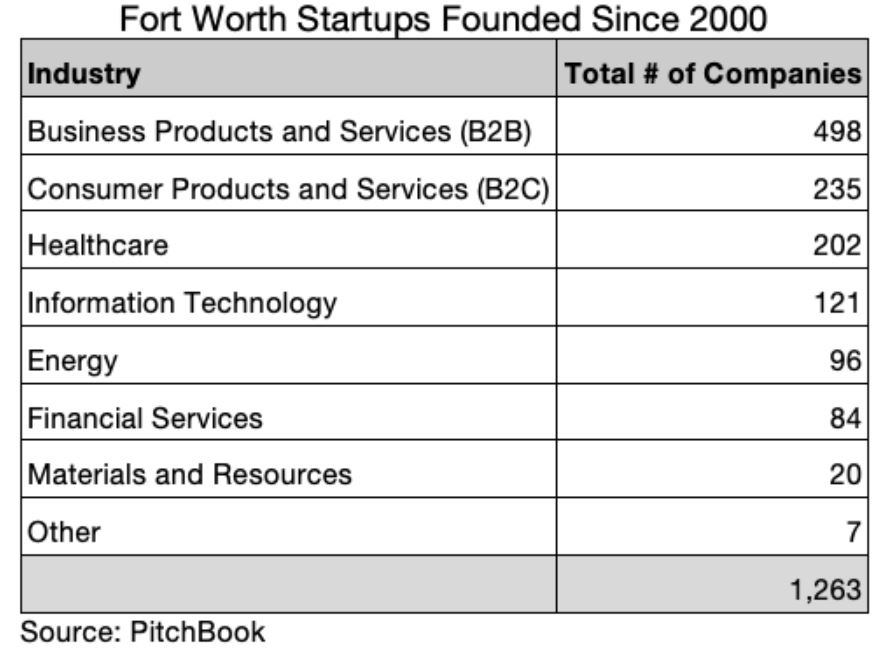

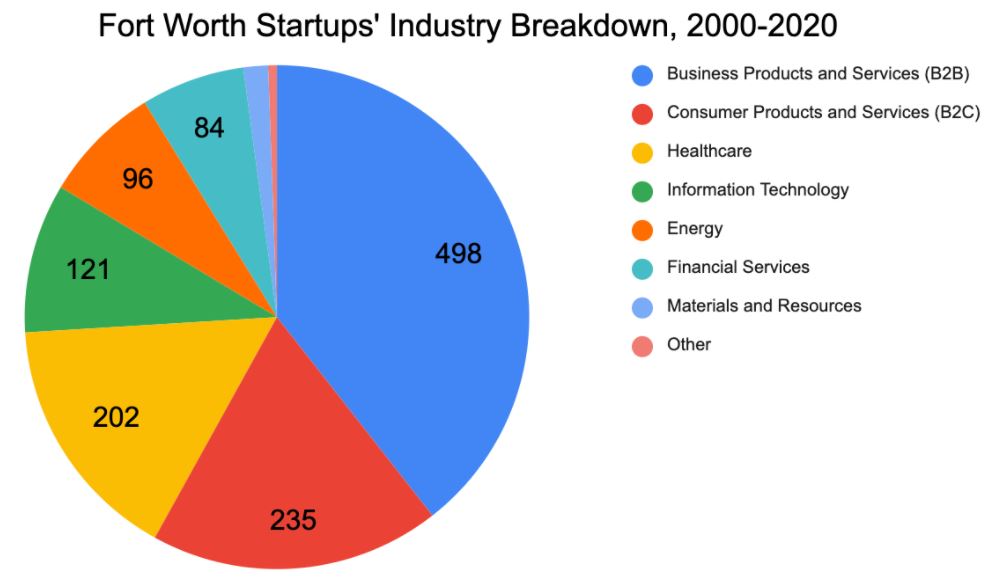

And, what if we could see what industries received early-stage startup capital? For the purposes of this analysis, we used Pitchbook, a well-known proprietary data source that captures data that covers private capital markets, including venture capital, private equity and M&A transactions. According to PitchBook, since 2000, entrepreneurs across Fort Worth have started 1,263 companies across numerous industries (Figure 1).

Keep in mind that this does not represent all of the companies started or growing in Fort Worth over this period. Each year, about 5,000 companies are started in Fort Worth, according to data from the Texas Secretary of State’s office. Pitchbook is only tracking a small number of these companies that tend to be capital intensive and of a high growth nature. In other words, your nail salons and restaurants won’t show up on this list, but your oil & gas, biotech and high tech companies will. Nevertheless, PitchBook data is more than sufficient to allow us to make generalizations on companies and industries in our area.

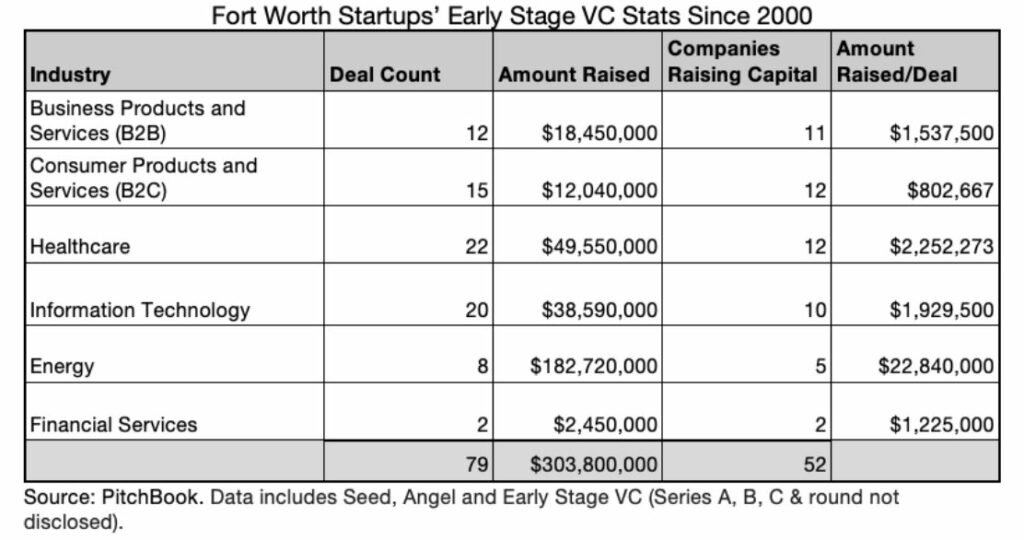

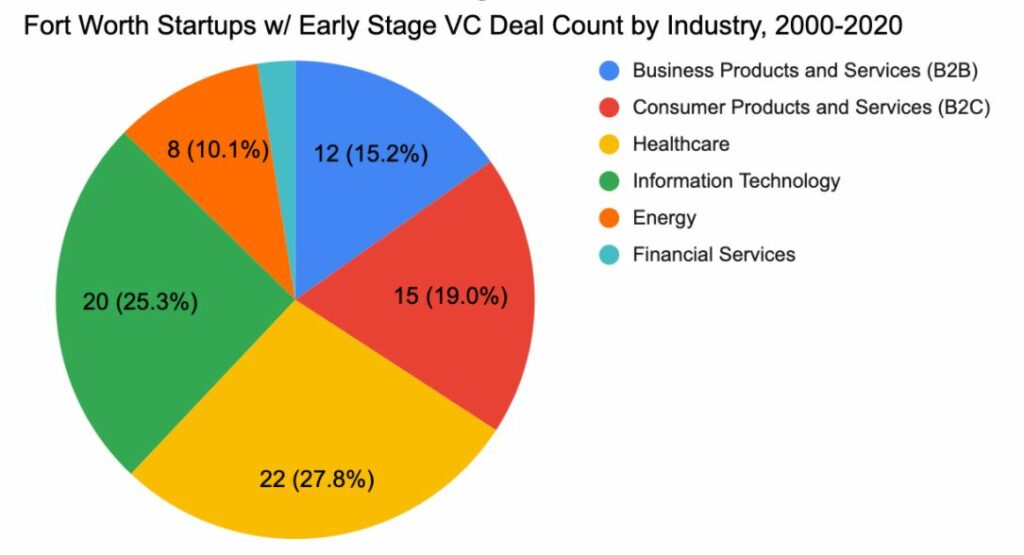

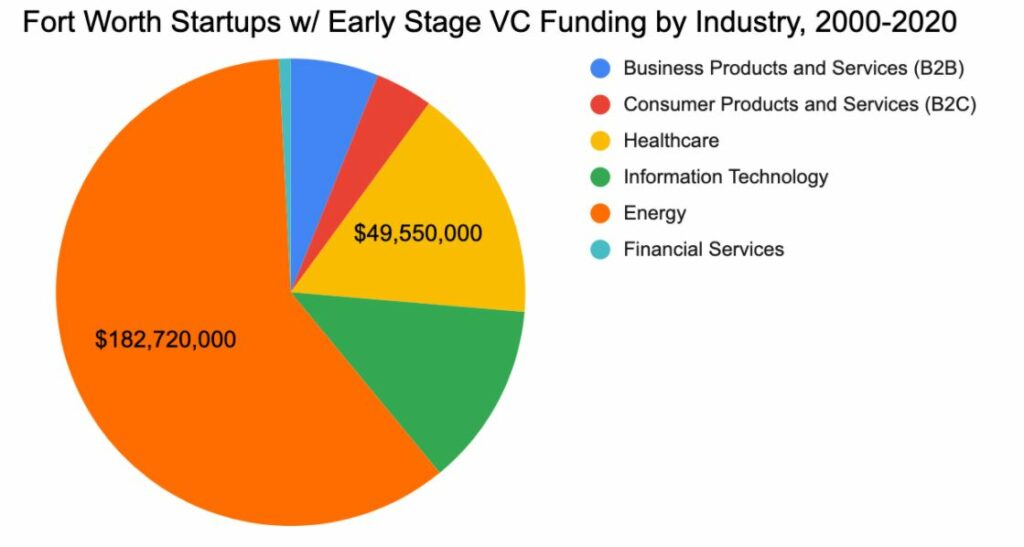

Of this small sample of companies, only 52 raised any kind of early stage capital, which we define as angel, seed and early stage venture capital funding, for a total of $303.8 million (Figure 2). Of these 52 companies, only a small portion raised capital in more than one deal, meaning that most of these companies only sought one “deal” or one round of funding to accomplish their growth plans.

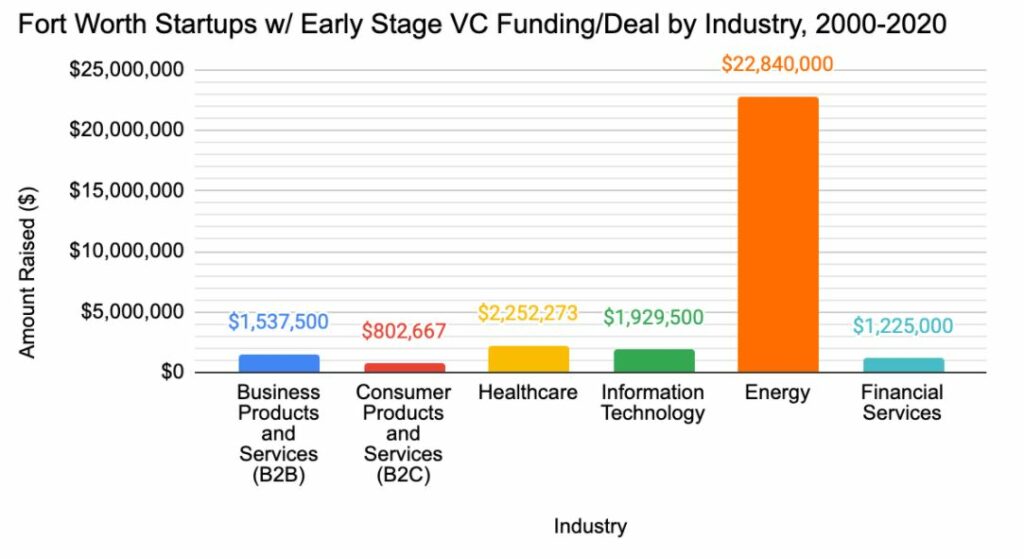

Figures 3 – 6 show the breakdown of Fort Worth startups, VC funding, and deal count by industry.

There are several takeaways from this data, but perhaps the most evident is the disparity of funding in the energy industry. This industry accounts for less than 10% of Fort Worth startups in the last 20 years, yet the energy industry in Fort Worth makes up 60% of total VC funded deals.

As these charts indicate, the capital is flowing in Fort Worth, but over the last 20 years, it has been largely flowing into one industry. This has led to a lack of investment diversification in our local economy and has created a vacuum of capital available for other early stage startup companies and has potentially left startups in other industries unfunded or underfunded. The bottom line is that there is no real incentive – from a startup capital standpoint – to launch a company in Fort Worth if it’s not in the energy sector. Given what we know about the importance of diversity in entrepreneurial ecosystems, this is something that needs to be addressed.

Keep in mind that this analysis represents only a sample of our overall economic activity over the last two decades. But, would anyone be surprised that our economy relies so heavily on the oil and gas industry?

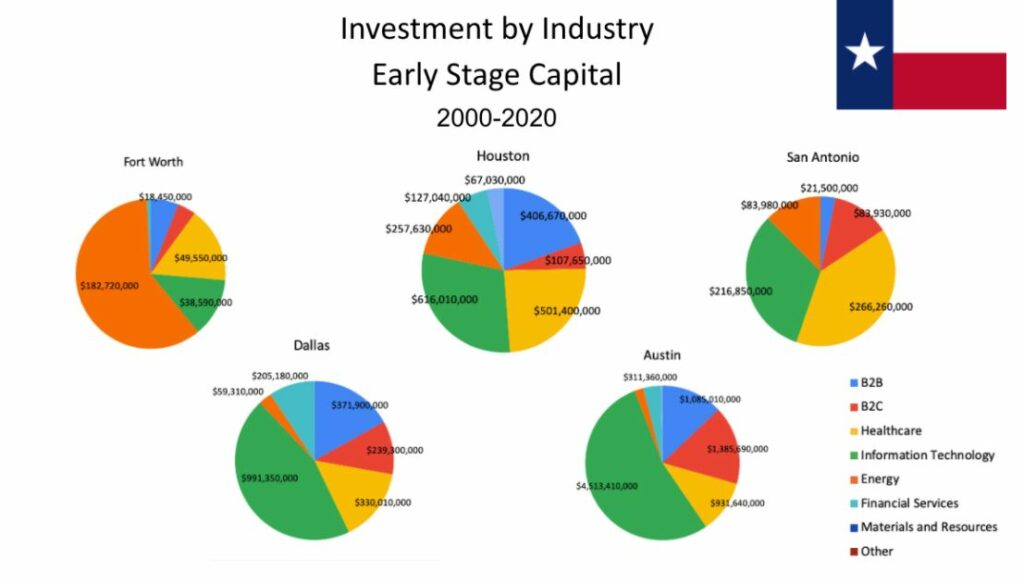

Next we looked at the breakdown of early stage investment by industry in the four Texas cities larger than Fort Worth, using the same data source and methodology.

All four of the other cities represent a more diversified approach to investments made in early stage industries. For example, they all invested in information technology to a much larger degree than Fort Worth. It is easy to see that Fort Worth’s economy has headed in a different direction than other peer cities.

If these numbers would have looked different over the last two decades, would Fort Worth have seen the development of other industries? Could startups like Airbnb, Pinterest, Uber, Slack or Stripe have been created in Fort Worth during this period? Would companies in other industries have had the capital required to grow quickly?

In the aftermath of the current economic downturn, where will the next big employers in Fort Worth be created? Will the investment community continue to invest in energy or will new and emerging industries take their place? And will those new companies have access to the capital necessary to grow? Only time will tell, but shifting our investment strategies and capital attraction efforts will require a significant effort moving forward.

Interested in seeing more stats on the Fort Worth entrepreneurial ecosystem? Click here to view other data related posts.

This post is a collaborative effort by Cameron Cushman, Assistant Vice President at HSC Innovation Ecosystems and Trent Barron, a previous Intern at HSC Innovation Ecosystems.

Cameron Cushman is a Fort Worth native who spent the last decade building entrepreneurial communities. He currently serves as the Assistant Vice President of Innovation Ecosystems at the University of North Texas Health Science Center at Fort Worth, where he is working to connect the startup community. He began his career in the George W. Bush Administration in Washington, DC, and served there for six years before he moved to Kansas City where he worked at the Ewing Marion Kauffman Foundation. While at The Kauffman Foundation, he led several initiatives to help build entrepreneurial communities including the co-founding of 1 Million Cups, a weekly educational event for entrepreneurs that is now in over 150 cities and 30 countries. He has also worked in the private sector as the Vice President of Sales and Marketing at PhysAssist Scribes, a medical services company. He attended Texas A&M where he earned a degree in Political Science and now lives in Fort Worth with his wife and three sons.