In a previous blog post, we looked at early stage capital investment in Fort Worth, and where the city stood in comparison to other Texas and US cities. We established that Fort Worth doesn’t have a lot of early stage capital, but it turns out there’s plenty of private equity (PE) money here, which tends to invest in later stage, more established companies. Relatively speaking, that assumption is correct. We looked at data from Pitchbook to see just how much PE was being invested in Fort Worth and how that compares to other Texas cities.

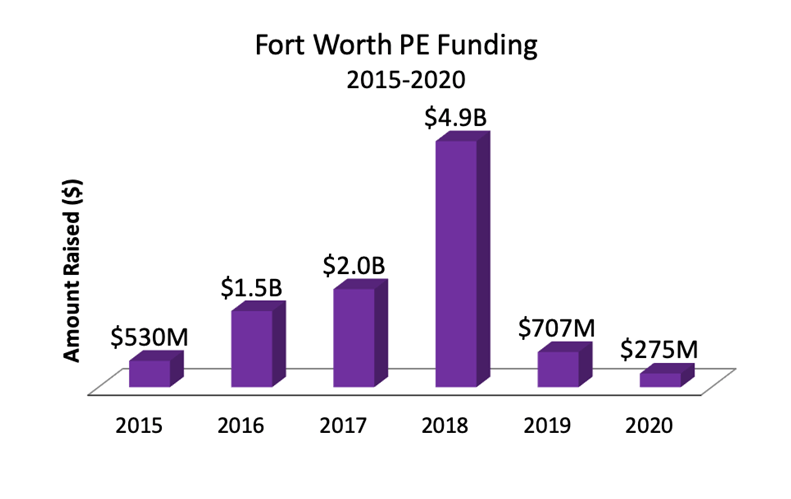

As seen in the chart below, companies based in Fort Worth have raised just under $10 billion in private equity since 2015. No matter who you compare us to, that’s a lot of money.

Before we go any further, it’s important to understand what exactly is meant by PE. Private equity is a kind of funding that is typically for older, more mature companies. PE usually comes from special firms and funds, as well as high net worth individuals. Whereas venture capital (VC) investment typically focuses on early stage companies with massive growth potential, PE deals have a broader portfolio that tend to focus on the less-risky, more mature companies.

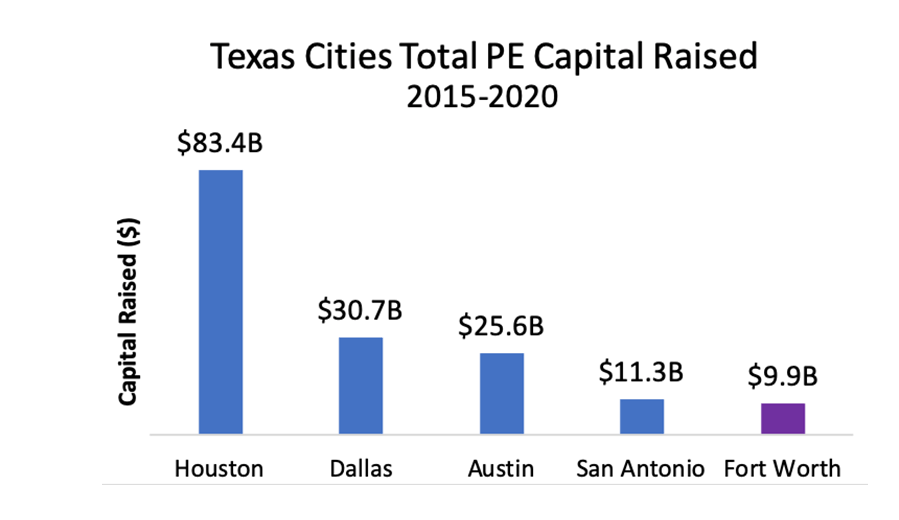

Now for the not so great news. Although Fort Worth companies were funded to the tune of $10 billion by private equity firms, the city ranks dead last in PE funding raised since 2015 when compared to our largest peer cities (by population) in the Lonestar state.

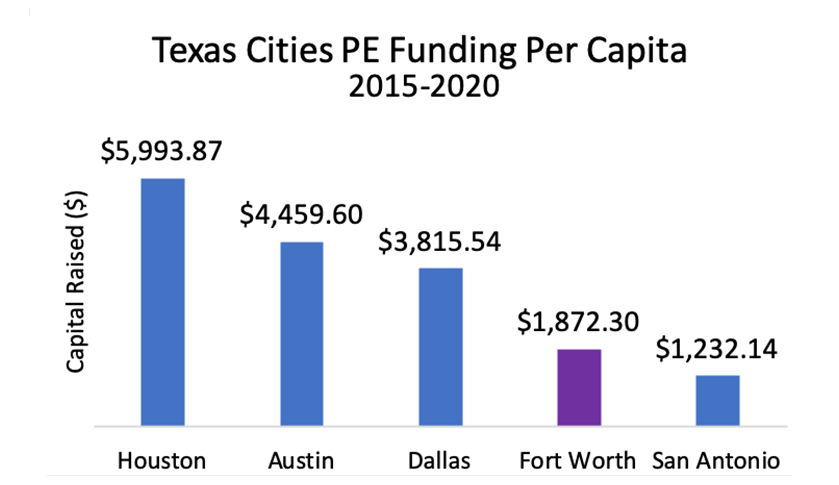

Now, Fort Worth is indeed the smallest of these cities. However, if we break it down on a per capita basis, as we did below, it doesn’t change the picture too much. But hey, at least we aren’t last!

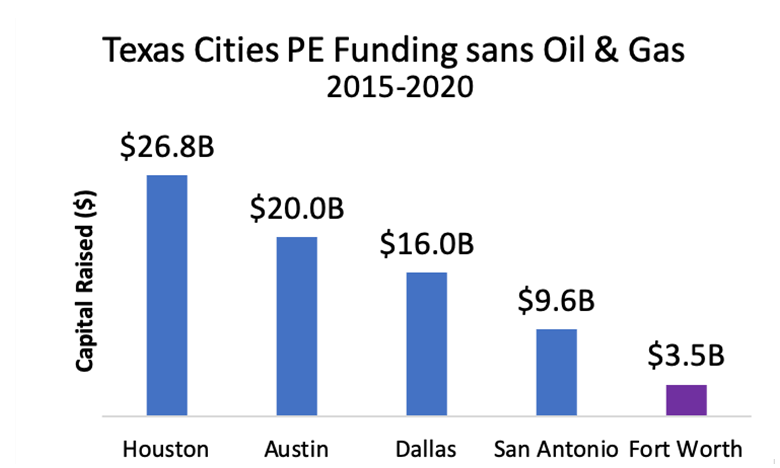

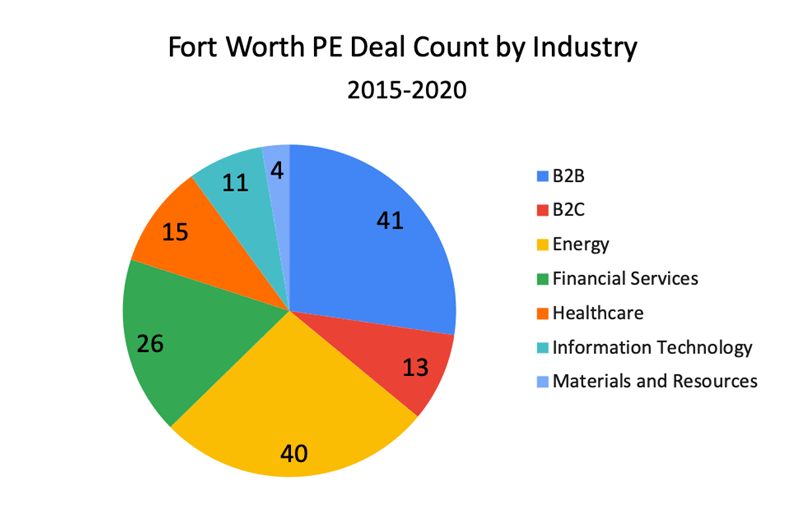

Another chart shows how much money not only Fort Worth, but the state of Texas as a whole, invests in the oil and gas industry. Below is a chart that shows Texas cities PE funding but without Oil and Gas investments.

The top 5 largest cities in the state, and 5 of the 13 largest cities in America lose over half of their PE funding when the energy industry is removed. For Fort Worth specifically, PE investment in Oil and Gas makes up about 65% of the total PE funding. As we have seen over the past few months, an economy built on oil prices can be a very unpredictable and unstable one.

One interesting thing to note is Austin, which has a reputation of being the most innovative city in Texas. As you will notice, Austin’s PE funding only decreased by about 20%, far less than the roughly 50% mark of Houston, Dallas, and Fort Worth. Why is that? Austin has embraced new discoveries, technology, and innovation in order to diversify and ultimately propel their city’s economic development to new heights.

We strongly believe that Fort Worth should take a page from Austin’s book and start to broaden our investment horizons, looking above the ground rather than below it. If our city doesn’t change, we will be left in the dust, stuck in our old ways while everyone around us looks to the future.

Private equity investments are just one small piece of a much larger puzzle, and one small indicator as to Fort Worth is behind. So what can we do? Spreading the PE funding around, getting outside of the Oil and Gas bubble, would be a great start. But the blame should not be placed solely on the investors. We as innovators and inventors and entrepreneurs need to begin to step out of our comfort zone and start creating great companies that these investors want to fund. The only way to succeed is if our community all works together.

Interested in seeing more stats on the Fort Worth entrepreneurial ecosystem? Click here to view other data related posts.